The real estate sector is expected to grow fast in the country following major investment the government has put on infrastructure in the country.

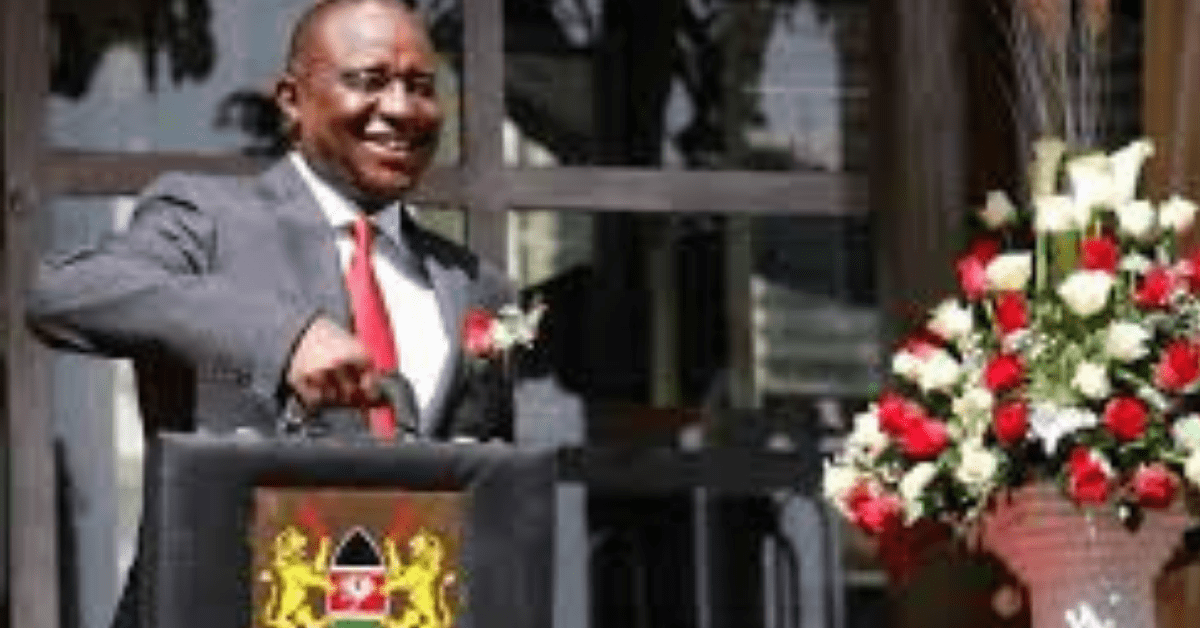

The National budget for 2018/2019 Financial Year allocated infrastructure the biggest amount of funds standing at Shs112.99 billion, Transport Sh90.42 billion while energy was allocated Shs 59.89 billion and in total, development will take 38.99 percent of the national government’s total allocation.

This is a huge support towards the growth of our economy which will encourage the private real estate sector to open up investment opportunities in areas close to urban centers which have been faced by lack of basic infrastructure causing potential investors to postpone their development plans as they await the development of infrastructure in such areas.

In summary

- Lack of basic infrastructure has caused potential investors to postpone their development plans

- Infrastructural growth has been mentioned as the key factor that creates a conducive environment that will open up areas close to urban centres

- Quality of infrastructure is a top consideration when determining where real estate investments are made in any country

- It is relatively cheaper to invest in an area before growth of infrastructure is fully experienced because once its fully experienced properties are scarce and unaffordable.

In a majority of discussions around The Affordable Housing Agenda, infrastructural growth has been mentioned as the key factor that creates a conducive environment that will open up areas close to urban centres for real estate development.

The Dictionary defines infrastructure as the basic physical and organizational structures and facilities such as buildings, roads and power supplies needed for the operation of a society or an enterprise.

In 2014, a research done by Urban Land Institute revealed that infrastructure is a top factor in driving where real estate sector development happens. The findings came from both the public and private sectors who rated the quality of infrastructure as a top consideration when determining where real estate investments are made in any country.

This is the same case in Kenya where investors prioritize areas with upcoming infrastructural developments.

On 13th August 2018, The Deputy President launched the Ngong-Ewaso Kedong-Suswa road in Kimuka shopping Center that is to be upgraded to Bitumen Standard. The 70 kilometers road has an allocation of 4 billion and has a working timeline of 24 months.

This will cause the prices of property in Ngong to increase further and those who invested in this area will soon reap the benefits. It is therefore advisable to invest in an area early before infrastructural growth is wholly achieved because properties are affordable but once development is fully achieved, the prices skyrocket.

In a case of Ngong, County Land Prices Report in April indicated that Ngong town closed 2017 at an average of Kshs.18.9m an acre, up from Kshs.10.3m at the close of 2012, recording the highest growth in 2017, at 12.9 percent. Ngong Town has attracted the middle classes who are retreating from Nairobi ’s noise, pollution, congestion and hiked land prices, and keen to invest in the affordable and serene area of Kajiado County.

Most of the town’s residents are Nairobi commuters, drawn by the town’s mix of commercial and residential developments and easy availability of building materials from quarries which provide stones for construction. Ngong town also has plenty of water from underground reservoirs.

As we also focus on an area such as Naivasha, phase 2A of the 120km SGR is already underway from Nairobi to Naivasha, speculation is set to raise the land prices in all the areas that it will pass through. These areas include Mai Mahiu, Longonot, and Naivasha.

In addition to this, the Parliament approved and allocated Kshs 3.4 Billion towards the construction of the Mega Industrial Park and freight exchange popularly known as Naivasha Dry port in Naivasha in April this year whose production units will be linked to markets by Phase 2A. This will be of advantage to all the investors who will invest in Naivasha this year.

In conclusion, the country is visibly experiencing infrastructural growth at county and national levels. This is enabled due to the availability of funds to finance these projects and the economic stability our country has continued to experience after the elections.

Investors should look out for areas that will soon experience booming growth through analysis of upcoming projects from the national and county governments, trusted real estate companies are also keen to conduct research and inform clients of upcoming projects and offer affordable properties in such areas.

This will allow every investor to have a share of a property in the growing areas because once the infrastructural projects are completed, such properties will be unaffordable. This is the right time to grab these opportunities.